Guest post by Amazon FBA seller, Luke Filer

Disclaimer: I do not claim to be a Tax Advisor/Accountant. I am purely speaking about my own experience of registering for VAT and then completing my first two VAT returns. I strongly advise you to speak with a Tax Advisor as VAT is a complicated issue.

Before going full-time with my Online Arbitrage business, I had completed two years of an Accounting & Finance degree as well as a couple of months of work experience at a small accounting firm. With this experience and a bit of sheer determination, I figured I would be able to do the bookkeeping for my Amazon business…

How wrong I was!

This mistake cost me so much wasted time and stress. It really wasn’t worth it!

In the end, I submitted both my first and second VAT returns at the same time. There is no penalty for the first return being late, and due to my poor attempt at bookkeeping, it was not possible to get my first return done on time. This does, however, mean that if any of my next four VAT returns are late, I’ll be fined by HMRC.

Unless you are a bookkeeper experienced with Amazon, I highly suggest outsourcing this element of your business. This is my biggest mistake and I wish I had outsourced this from the start.

Bookkeeping for Amazon is Very Complicated

I’ll give you some examples.

If you purchase something with a credit/debit card through Paypal checkout, it can be a nightmare because any existing Paypal balance will be automatically used which means only part of the transaction value will appear on your card statement. Furthermore, you have to ensure you don’t double the transaction by confirming it in both Paypal and the card’s bank account.

Other issues I found include the entries for gift cards, handling currency differences and more.

As an entrepreneur, you can’t specialise in all areas. This is one area I highly suggest is outsourced. Your bookkeeping needs to be correct in order to submit the VAT return — they go hand in hand.

Make sure you have a separate bank account for your Amazon business and keep it separate to your personal account!

It doesn’t have to be a business bank account, it can be a personal bank account which you use for business, but just make sure you keep all personal and business transactions separate.

Another example of not keeping business and personal stuff separate would be purchasing a mixture of the two. I have previously ordered stock from a retailer and added in some personal items I needed, meaning the order was mixed of both personal and business goods. Don’t do this, it makes life very complicated.

Make sure you keep everything business-related separate to everything personal. If they do overlap, like a phone bill, let your bookkeeper know so they can adjust for this.

Introduction to VAT

In simple terms, VAT is a tax on the sale of goods and services. You pay VAT on the majority of goods and services in the UK. I will not go into lots of detail on how VAT works, as there are plenty of guides online.

The current rate of VAT in the UK is 20% on most goods and services. However, on some goods, a VAT rate of 5% or 0% is used.

Businesses with revenue of over £85,000 in any 12-month rolling period must register for VAT and they then have to charge VAT on any products sold, but they can also then claim VAT on products purchased. This is important as you can only claim back VAT on products supplied by businesses that are VAT registered.

Once VAT registered, you will have to complete a VAT return every three months. This return looks at how much VAT you’ve paid, and how much VAT you’ve collected (from sales). You have to subtract the first from the second, and if this figure is positive (which it normally will be), then you pay this to the Government (HMRC).

How I Registered For VAT

Since the threshold for registering for VAT is £85,000, I sold up to around £82/83k as a Sole Trader (self-employed) and then formed a Limited Company in May 2019.

Since the Limited Company is a separate legal entity to the Sole Trader, the VAT threshold effectively “resets”. This means that I could again sell another £82/83k worth of goods before I registered for VAT on the 1st of October 2019.

The obvious benefit of this is that you get an extra £85k worth of VAT free sales. This is good as being VAT registered reduces profitability.

Before making this plan, I did my research to find out whether VAT registration was for me. See below for some of the considerations that helped me with this decision.

1. Effect on Profitability

I’ll use a very basic example to explain this. In this scenario, we will consider a VAT registered seller and a seller who hasn’t yet registered for VAT.

The scenario is simple, we buy a product for £50 which we then sell for £100. We assume no other expenses for simplicity and a VAT rate of 20% for the product.

The seller who isn’t VAT registered makes £50 (£100-£50) but the seller who is VAT registered makes £40.

Why is this?

Because they can reclaim 20% of their cost (£10). However, they have to remit 20% of the sale price (£20). This means it’s £80-£40, which is a profit of £40.

Expenses are important as you can claim the VAT back on these, provided the service provider is VAT registered. We will continue the previous example to illustrate this.

Say our expenses are as follows (we will assume all providers are VAT registered).

- £8 in Amazon fees

- £1 prep centre cost

- £1 in other services (all software costs apportioned)

This means that the non-VAT registered seller now has a profit of £40 (£50-£10).

The VAT registered seller can claim back £2 in VAT on these £10 worth of expenses, meaning their profit figure is now £32 (£40-£8).

So claiming VAT back on expenses reduces the impact on VAT registration. Let’s check out some other factors which will also impact profitability and aid your decision making.

2. Extra Admin Costs

I highly suggest you outsource bookkeeping and VAT returns to a qualified accountant. Yes, this will incur a significant monetary expense, however, not doing this will cost you a lot of time, and potentially a lot of money — both in fines and also from not maximising what you can claim.

This being said, you do need to be aware of these additional expenses involved in being VAT registered. You also may have to spend more time/money as invoice collection and general record keeping becomes even more important.

3. 0% Goods

Following the discussion on the effect on profitability, it is important to look at the impact of goods that have a 0% VAT rate. At first glance, it may seem that this would be the same as being non-VAT registered, however, that’s wrong and these are even better, as you can still claim back VAT on expenses, which a non-VAT registered seller can’t.

If we refer back to the previous example and assume this is instead a 0% VAT good, the profit would be £42. This is because before expenses the profit would be the same as a non-VAT registered seller (£50), but you can claim back the £2 VAT on expenses, meaning the profit figure is £42, £2 higher than that of a non-VAT registered seller.

If you can source lots of 0% goods, then your profitability will be impacted less by VAT registration!

The issue is that 0% goods are hard to come by. I won’t make a list, as you will need to research these. GOV.UK provides a good starting point for your research.

Should You Register for VAT?

I am aware there are a lot of negative points here but ultimately if you’re looking to do this seriously, it’s an inevitable step.

To decide whether this step is right for you though, you need to consider the factors and weigh them up against your personal situation. For some, ticking along at around £80k a year in sales and doing this part-time works perfectly for their business. For others, like myself, VAT registration was an inevitable step as I made the decision (after weighing up impacts on my business) that I wanted to do this full time.

I would suggest you try to understand your profit margin now and consider what it may be after VAT registration. Have a look at some products you’re selling and consider if you could still sell them if VAT registered?

Consider whether you have the resources to increase your revenue. Whilst you can take steps to reduce the impact of VAT registration on profitability, ultimately it will lower your profit margin.

For example, if you sold £150k of goods at a profit margin of 9%, is this better than £80k at 12%? How about if you can do £200k at 8% or 9%? Consider the extra time and resources needed to hit these figures.

One tip I would give is to have a call with a seller who is VAT registered and ask them questions. Don’t rush this decision! It’s a big one, with no obvious right or wrong answer, as it depends on your personal circumstances.

If you do decide to register then one thing you need to do is…

Stay on Top of Invoice Collection

Whilst a lot of retailers will provide invoices for any orders stored in their records, some only provide invoices for recent orders and other unforeseen events may occur. It’s important to stay on top of invoice collection. A good example here is Mothercare, who went into administration and now you can’t get invoices from them.

I suggest you make sure you don’t have any outstanding invoices over 30 days old. Build a system for this and stick to it. You should work with your bookkeeper to build a system that works for both of you.

Claiming VAT – Suppliers

The Reverse Charge Mechanism

The European Reverse Charge Mechanism is something you need to be aware of. I won’t explain the details of it here, as there are guides that do this better than I can.

What I would like to note is that you should check invoices provided by businesses based in Europe to ensure they meet the correct specifications. Check this with your accountant if unsure.

A lot of the time you need to provide these businesses with your GB VAT number before making a purchase. If they already have a GB VAT number, then this won’t be an issue.

Businesses Outside of Europe

Whilst I don’t usually source products from outside of Europe, I do use some software providers. For example, you won’t be able to claim back any VAT on a Tactical Arbitrage subscription, as this company is based in Australia and there is no VAT element.

Effects on Sourcing

An issue I have encountered being VAT registered is identifying the VAT rates on products at the time of purchase. Once an invoice is supplied by the supplier, you can see what VAT rate they have charged and this is usually what you will charge on the product you sell.

The issue is you need to know what the VAT rate is at the time of purchasing, as this can be the difference between a good product and a bad product.

From the two VAT returns I have assisted in completing, I now have a good idea of the VAT rates on products. You can research the VAT rated for products (Google, HMRC website) and over time you will begin to learn what the VAT rate is. This is fine, but for those like me using VAs (Virtual Assistants) to source, it’s not necessarily feasible to teach them all the VAT rates on different products.

What I have done (and you may have a better system) is to get VAs to assume a VAT rate of 20% on all goods, unless they are in the grocery section, in which case they need to analyse at both 0% and 20%. This is because a lot of groceries are 0% rated. I have also built up a database of all 0% products purchased which helps with future replenishment.

The final tip on this point is to be careful with deal analysis tools, like BuyBotPro etc, which can be misleading. They assume the VAT rate based on the category and this is obviously not always correct. Make sure to check this when purchasing! I would recommend Seller Amp which lets you configure the VAT rates on items you analyse.

VAT Rates in Amazon

You need to set the VAT rates for the products you sell. This is done when you add your inventory to Amazon. If you do not do this, Amazon will assume the product sold has a VAT rate of 20%.

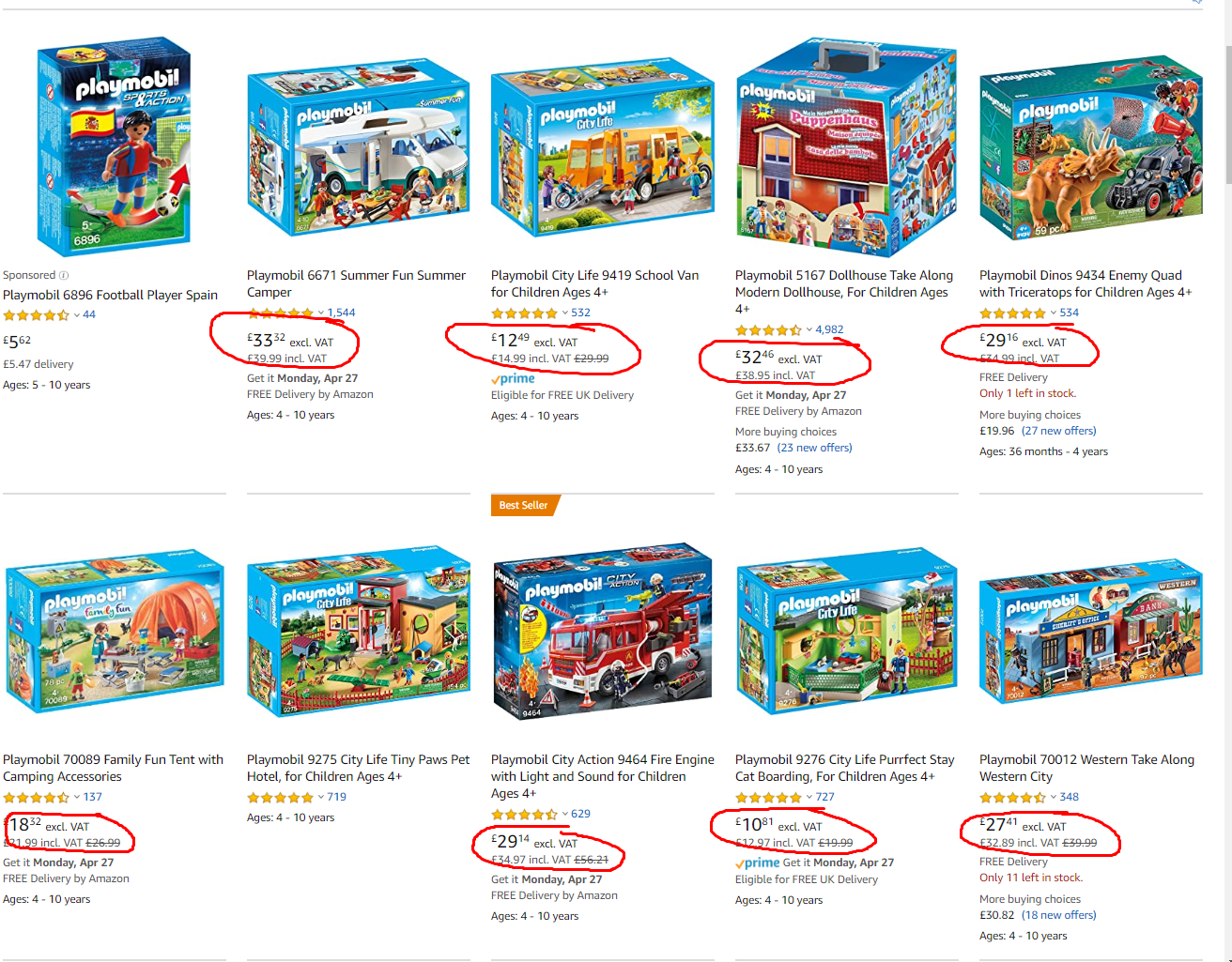

Checking VAT rate

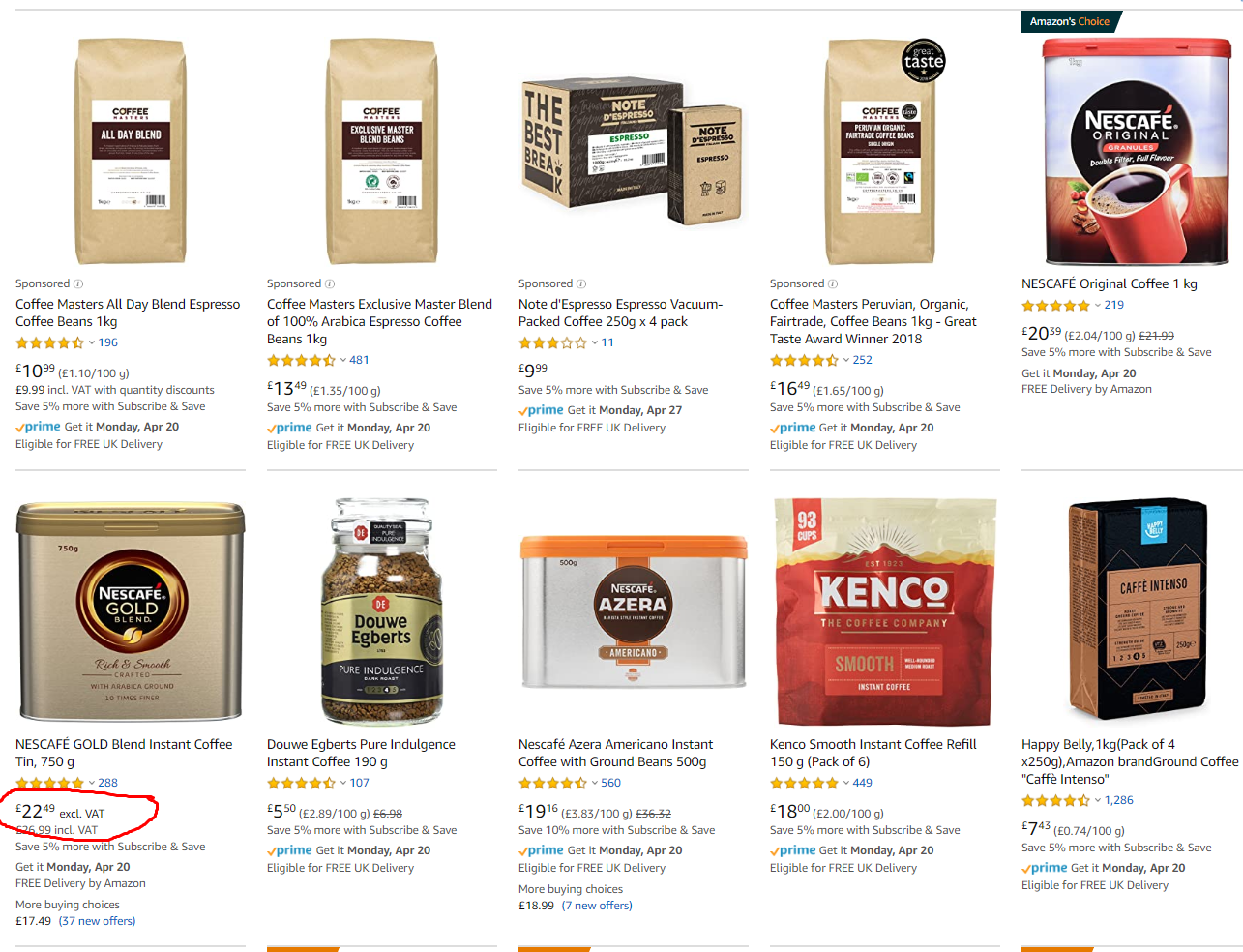

If you are unsure on the VAT rate of an item, you can use an Amazon business buying account to check. Simply log in to your Amazon account and search for the product. Go onto the Amazon business account and search for items. See if prices are excl or incl of VAT.

In the example above I searched for “Playmobil”, as all Playmobil toys are standard rated at 20% VAT. You can see that most of these results show prices excl and incl of VAT because there is a 20% VAT element.

In the second example, I searched for “Coffee”, as Coffee is zero-rated at 0% VAT. You can see there was only 1 result which has a VAT element, I assume this seller has entered an incorrect VAT code, but this highlights that this method isn’t perfect, but it could help for items you are unsure on.

Final Thoughts

We hope you found this blog useful. One final tip for VAT registered businesses is to budget for your VAT bill as you will accrue a liability in the form of VAT owed to HMRC over a three-month period—you need to budget for this so that you have the cash to pay the bill once you submit your VAT return.

Amazon seller in the US? Check out our guide to Amazon sales tax.

Interested in getting more advice for selling on Amazon? Check out the iGen Entrepreneur community on Facebook.

Related: Is Amazon Lending the Right Loan for Your FBA Business?